The Fast Close Movement Is Not Over

Manual workarounds are still number one when it comes to data preparation and closing at single entity level, resulting in Excel still playing a major role in the process

BARC-Survey “Account Reconciliation and Closing – The Journey from Excel to Artificial Intelligence” published

- The level of automation of group accounting is still very weak

- Manual workarounds are still number one when it comes to data preparation and closing at single entity level, resulting in Excel still playing a major role in the process

- Faster closing is still the main challenge that companies will face in the coming years

BARC (Business Application Research Center) today published the results of its topical survey “Account Reconciliation and Closing – The Journey from Excel to Artificial Intelligence”. In the study, Dr. Susanne Leitner-Hanetseder, Professor of Accounting at the University of Applied Sciences Upper Austria in Steyr, and BARC Fellow Stefan Sexl offer insights into current practices around account reconciliation and the closing process and show to what extent and with which IT solutions consolidated financial statements are prepared. They also examine the possibilities to improve consolidated statements and the associated challenges. The study is available for download free of charge thanks to sponsorship by Wolters Kluwer.

According to a new BARC survey, the opportunities for automating the group accounting process are not yet recognized. Many companies still operate with a low level of automation. Only 1% of the companies surveyed considers their automation of consolidated financial statements as excellent. The overall degree of automation of group accounting processes is quite weak.

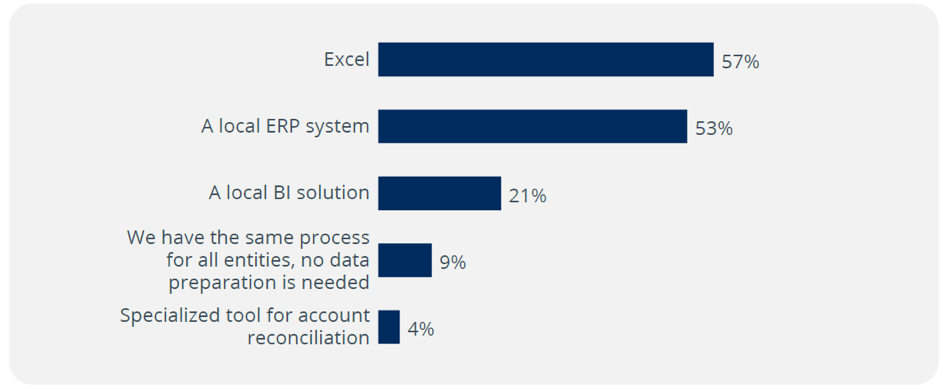

This is also represented by the finding that manual workarounds are still number one when it comes to data preparation and closing at single entity level. 57% of participants state that they use Excel for data and closing preparation in single entities (See Figure 1). Although the closing of consolidated financial statements is usually done by the parent company, an optimized group accounting process starts with data preparation and reconciliation at single entity level.

“Companies tend to overlook the inherent risks of using Excel, such as a lack of division of duties, no options to standardize processes, no control over preparation, review and approval, limited speed and reconciliation”, said Dr. Susanne Leitner-Hanetseder, Professor of Accounting and co-author of this study.

Faster closing is still perceived as a major challenge, but there are more issues to solve

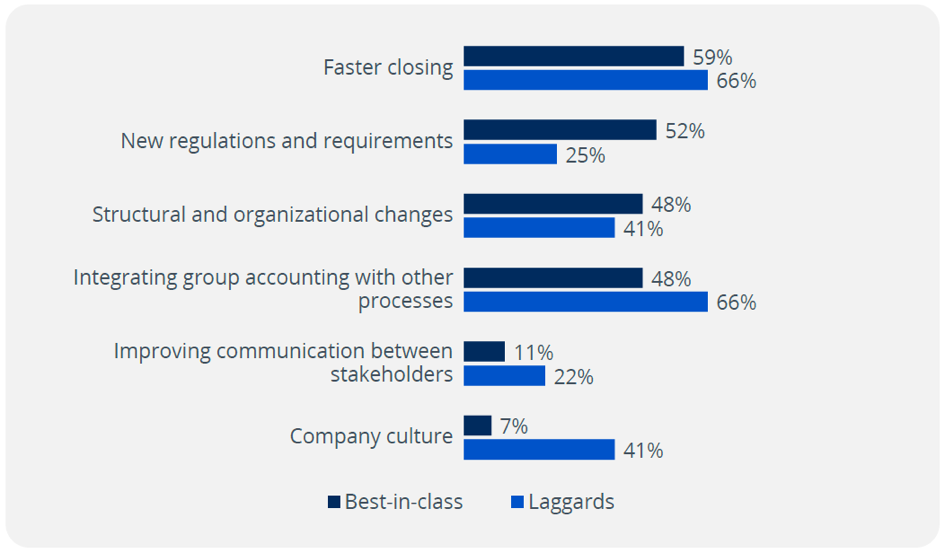

Aiming for faster closing is nothing new in the corporate world. However, many companies have not properly addressed this goal yet. Asked about the challenges perceived with regard to account closing and reconciliation in the next 3 years, faster closing is revealed as a major pain point. Even when broken down by maturity level (best-in-class companies versus laggards), fast closing is no less significant (see Figure 2).

The study underlines that fast closing has not been achieved to a satisfactory level yet and that, even in best-in-class companies, there is room for improvement.

A faster close also requires that the group accounting process is integrated with other processes to reduce time lag. The study results show that this integration of processes represents a challenge of its own for many companies given their current disparate systems and dependency on Excel.

A key factor is the creation of an end-to-end reporting process, from recording through consolidation and reporting, and executing within one model. Group accounting processes also depend on regulations and requirements such as shorter deadlines. Therefore, there is a need to adapt processes when regulations or requirements change. Furthermore, due to the “digital transformation”, companies will have to adapt or change their business models. “Companies realize that the necessity to change structures and make organizational changes also requires them to adapt processes for group accounting”, said Stefan Sexl, BARC analyst and co-author of the study.

About The Survey

Account Reconciliation and Closing – The Journey from Excel to Artificial Intelligence is a topical BARC survey about current practices around account reconciliation and the closing process. The study is based on a survey of 110 companies from various industries and of different sizes in the DACH region. The focus of the study is to show to what extent and with which IT solutions consolidated financial statements are prepared. The study also examines possibilities for improving consolidated statements and the associated challenges. The authors of the study are Dr. Susanne Leitner-Hanetseder, Professor of Accounting at the University of Applied Sciences Upper Austria in Steyr and Stefan Sexl, BARC Fellow.