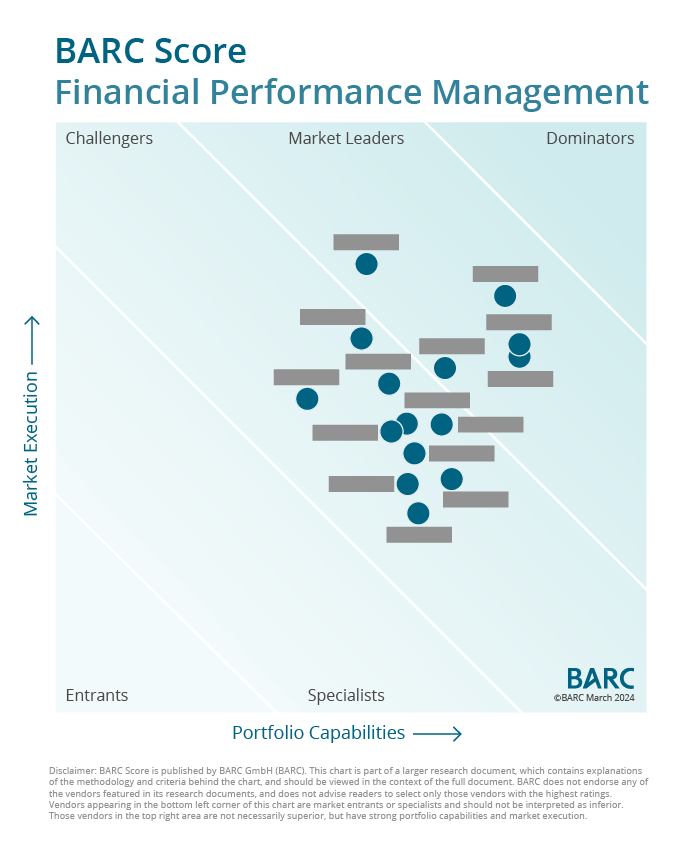

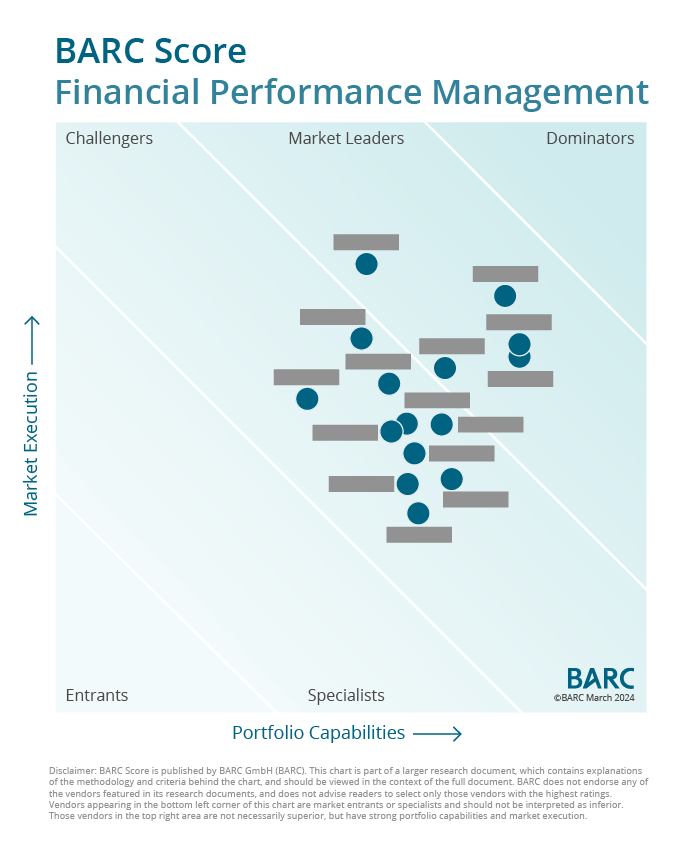

BARC Score Financial Performance Management

BARC Score Financial Performance Management allows you to compare the portfolio of 15 manufacturers at a glance.

To purchase the BARC Score, please contact us.

Get in contact

With the help of BARC Score Financial Performance Management

- you will get a detailed overview of the market for FPM products and portfolios.

- you can assess the market position and portfolio of software vendors.

- you have the foundation to build your long list or short list.

Further information

Performance management plays a crucial role in increasing the competitiveness of companies and is one of the central management tasks in the organization. The goal is to align the company’s strategy and goals with business processes in order to achieve the highest level of performance at strategic, tactical and operational levels.

In recent years, the dynamics of markets and competition have increased rapidly and many companies are struggling to keep pace.

In this context, the management and monitoring of financial results across the organization are becoming massively more important. Therefore, financial performance management (FPM) is key for many companies and focuses on streamlining financial management processes.

Performance management is a set of management processes that help organizations control, monitor and improve the effectiveness and efficiency of their performance:

- Strategy management

- Planning, budgeting and forecasting

- Governance, risk management and compliance

- Group consolidation and external reporting

- Reporting and analysis

The software market for financial performance management solutions is highly competitive. In addition to a few global software generalists, many specialized software vendors offer their products.

Selection of vendors

There are two separate categories of inclusion criteria for this BARC Score: the first is associated with a vendor’s products and portfolios and the other is linked to the financial results relating to those products. To be evaluated in this BARC Score, a vendor has to have a strong focus on providing FPM functionality (not only analytics functionality) and supply at least four out of five technologies from the following list in a solution not merely focused on one industry or use case:

- Financial planning

- Financial consolidation

- Reporting

- Analysis

- Operational planning & forecasting

In addition, a vendor has to generate a minimum of 25 million EUR in revenue per year (software revenue) with the evaluated product set in this BARC Score. The product set must have a significant number of implementations and license or subscription revenues worldwide across different geographies to be considered as global.

We consider the following regions as individual geographies:

- Europe, Middle East and Africa

- North America

- Latin America

- Asia-Pacific

There is no differentiation between on-premises offerings and cloud-based product sets.

| Vendor | Product name |

|---|---|

| Anaplan | Anaplan |

| Board International | Board |

| IBM |

IBM Planning Analytics IBM Cognos Analytics IBM Controller |

| insightsoftware |

Bizview Calumo Certent CXO IDL Longview Power ON Viareport Additional insightsoftware portfolio products |

| Jedox | Jedox |

| LucaNet | LucaNet |

| OneStream Software | OneStream |

| Oracle |

Oracle Cloud EPM Oracle Hyperion EPM Oracle Analytics Cloud Oracle Analytics Server |

| Planful | Planful |

| Prophix | Prophix |

| SAP |

SAP Analytics Cloud SAP Business Planning and Consolidation SAP BusinessObjects BI SAP S/4HANA Finance for Group Reporting |

| Unit4 | Unit4 FP&A |

| Vena Solutions | Vena |

| Wolters Kluwer | CCH Tagetik |

| Workday |

Workday Adaptive Planning Workday Financial Management Workday Prism Analytics |

Software evaluation

Software providers are evaluated on two dimensions, ‘Portfolio Capabilities’ and ‘Market Execution’, each representing an axis on the chart.

In addition to BARC’s analyst opinion, user experience also plays an important role.

For our Scores in the areas of BI, analytics and business planning, we draw on the world’s largest surveys for BI & analytics and planning software, the BI & Analytics Survey and the Planning Survey, which ask companies each year about their satisfaction with software vendors and solutions.

Detailed analyst knowledge and comprehensive survey results are summarized in the BARC Score report and chart. The chart provides a clear view of each vendor’s market position and portfolio.

Authors