BARC Survey Reveals Big Increase in Use of Cloud Planning

Surge in Predictive Planning Expected.

- The sixth edition of The Planning Survey is out now. With 1,400 respondents, it is the largest survey on the selection and use of planning software on the market.

- Survey results show that companies are increasingly focusing on planning in the cloud.

- Predictive planning and integration with BI and analysis functions are also increasing in popularity.

The analyst firm BARC published The Planning Survey 20 today at its annual Digital Finance and Controlling conference, which is taking place online due to the Covid-19 crisis. This major study collates feedback from over 1,400 professionals on their use of software for planning and budgeting. Available at bi-survey.com.

Cloud planning sees big increase

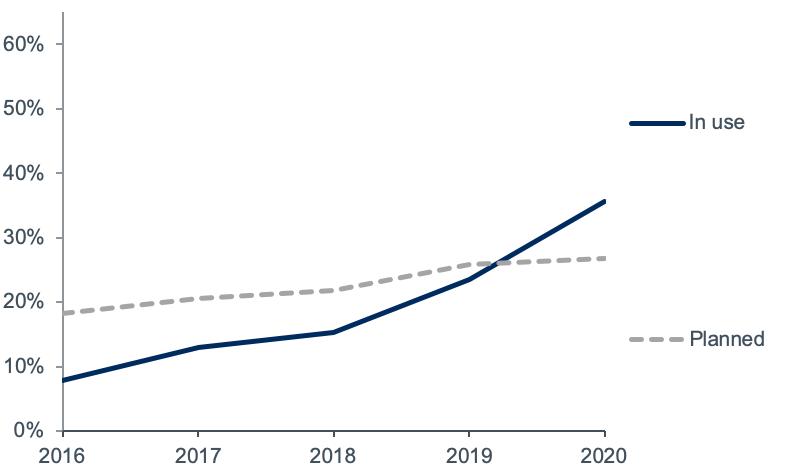

Use of cloud planning has jumped from just 8% of survey respondents in 2016 to 36% in 2020. The last two years has seen especially strong growth. Meanwhile, 51% claimed they saw no need for cloud-based planning in 2019, but that figure has dropped to 38% this year. Just 27% now have plans to use the cloud, among the lowest ‘planned’ rates this year.

“For the first time, there are now more companies actually doing their planning with cloud-based software than those intending to do so in the future,” said Christian Fuchs, senior analyst at BARC and author of The Planning Survey 20. “Several purely cloud-based planning products have emerged in recent years, particularly in the United States, and some have already gained significant market share.”

Surge in predictive planning expected

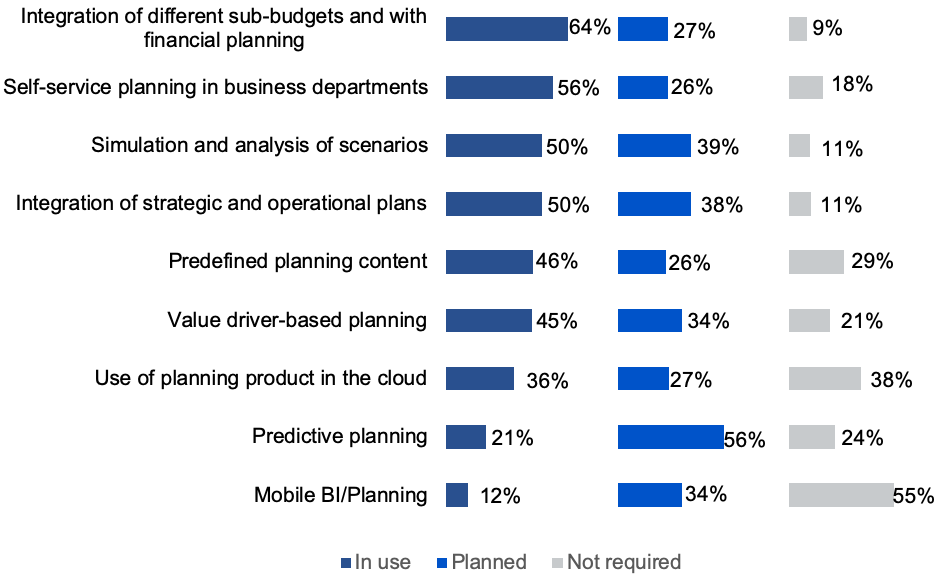

64% of respondents consider predictive planning and forecasting to be very important for their business. At present, it has been deployed in only 21% of the companies surveyed but a healthy 56% have plans to put it in place. The main incentives of predictive planning are to achieve a better quality of extrapolations and simulations (cited by 53% of respondents), relief of planners (47%) and easier identification and evaluation of drivers (46%).

“Planning vendors are currently investing massively in the integration of statistical methods, machine learning and artificial intelligence to support their customers,” said Fuchs. “In the future, BARC expects to see ready-made solutions that are easy to understand and lead to reliable results. Less statistical know-how would be required to use them and the demand on resources would be reduced due to their prefabricated nature.”

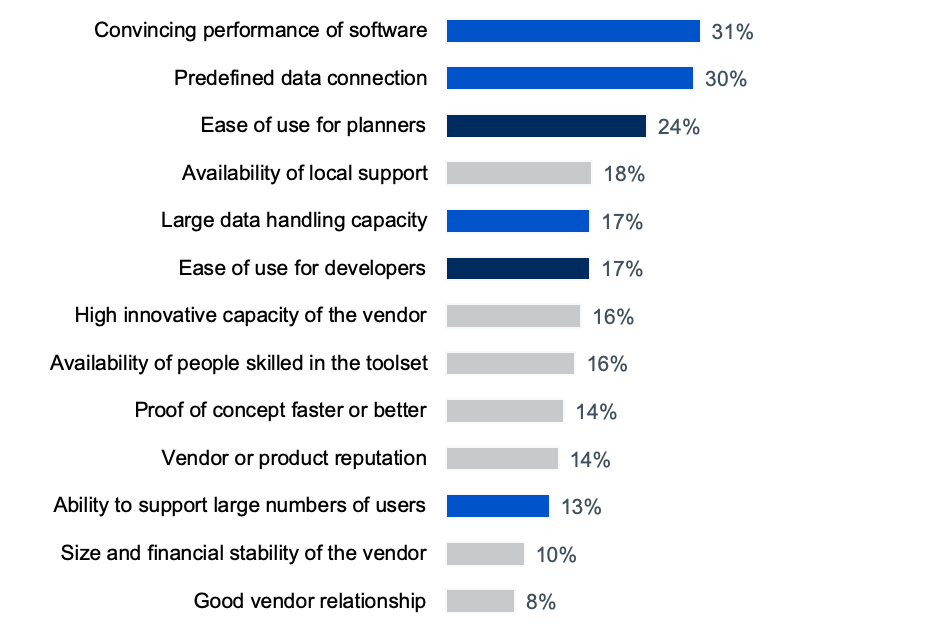

Buyers want flexibility and planning functionality, but integration with BI is also desirable

Flexibility and planning-specific functionality have been the two main reasons why companies buy their planning products over the last three years. But perhaps more interesting is the importance attached to reporting and analysis requirements. This finding underlines the importance of integrating planning with classical business intelligence (BI) and analytics functionality such as reporting, analysis and dashboards.

“While planning is an important element of management control to align operational business with strategic corporate objectives, its success also depends on comprehensive analytics and BI functionality,” said Fuchs. “BARC has observed that the maturity level of integrated planning and analytics software has now reached a very high level, and it appears that many companies recognize the advantages of integrating the two areas, ideally within the same software product.”

About The Survey

The Planning Survey 20 is the sixth edition of BARC’s major annual study into the selection and use of planning tools. The findings are based on a worldwide survey of 1,406 planning users, consultants and vendors, which was conducted from November 2019 to February 2020. It features analysis and comparison of 23 leading planning products based on user feedback, as well as current data on market trends and the selection and use of planning tools. Find more at barc.com/research/the-planning-survey/